Week Thoughts: Falling Behind

MLPs win rough week for energy stocks

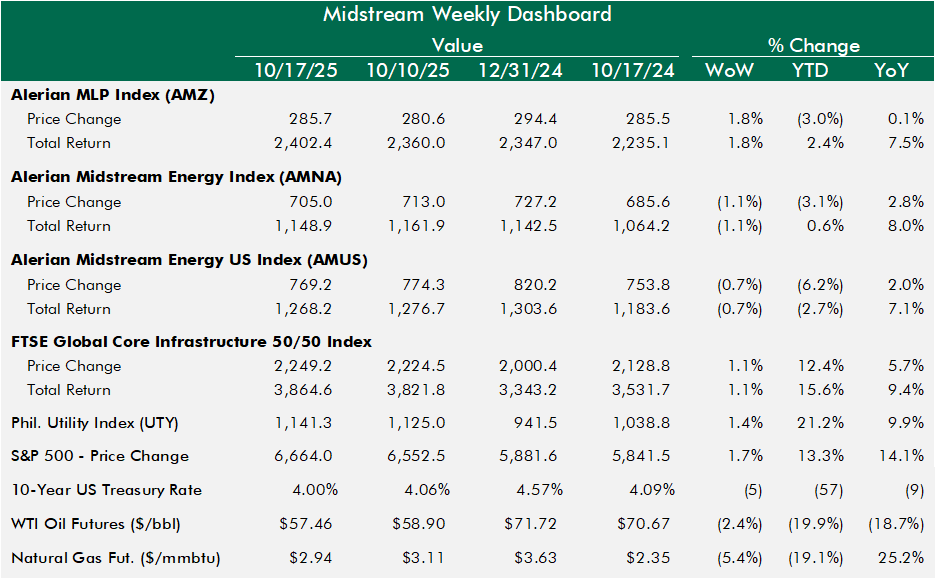

The market finished positive for the week, and so did utilities and infrastructure. But midstream was mixed, with all of Canada and most of U.S. corporations negative and most MLPs positive. The 10-year interest rate closed the week at 4.00%, mortgage rates are at their lowest point of the year so far, which seems good. But oil prices hit their lowest point in nearly 5 years, which is not good for sentiment around energy stocks and midstream stocks. The AMNA return so far this year is only slightly above 0%, counting the dividends. That is way off the pace of the market, utilities and infrastructure, but its much better than the -20% moves in commodity prices.

KMI earnings are this week, kicking off 3Q earnings season. Sometime during earnings season, Trump and Putin are expected to meet to discuss an end to the war in Ukraine. Peace could mean more Russian oil and natural gas hitting an already oversupplied market, and it seems that got reflected in oil prices this week. But it could be even more reflected on the actual announcement.

Even so, I maintain that midstream and MLP distributions are in good shape, and in many cases growing at healthy clips. Affirmation of that in the coming weeks may help combat some of that negative macro energy sentiment that continues to overwhelm.